Credit Card Defaults Rise Most During Era Of ‘Bidenomics’

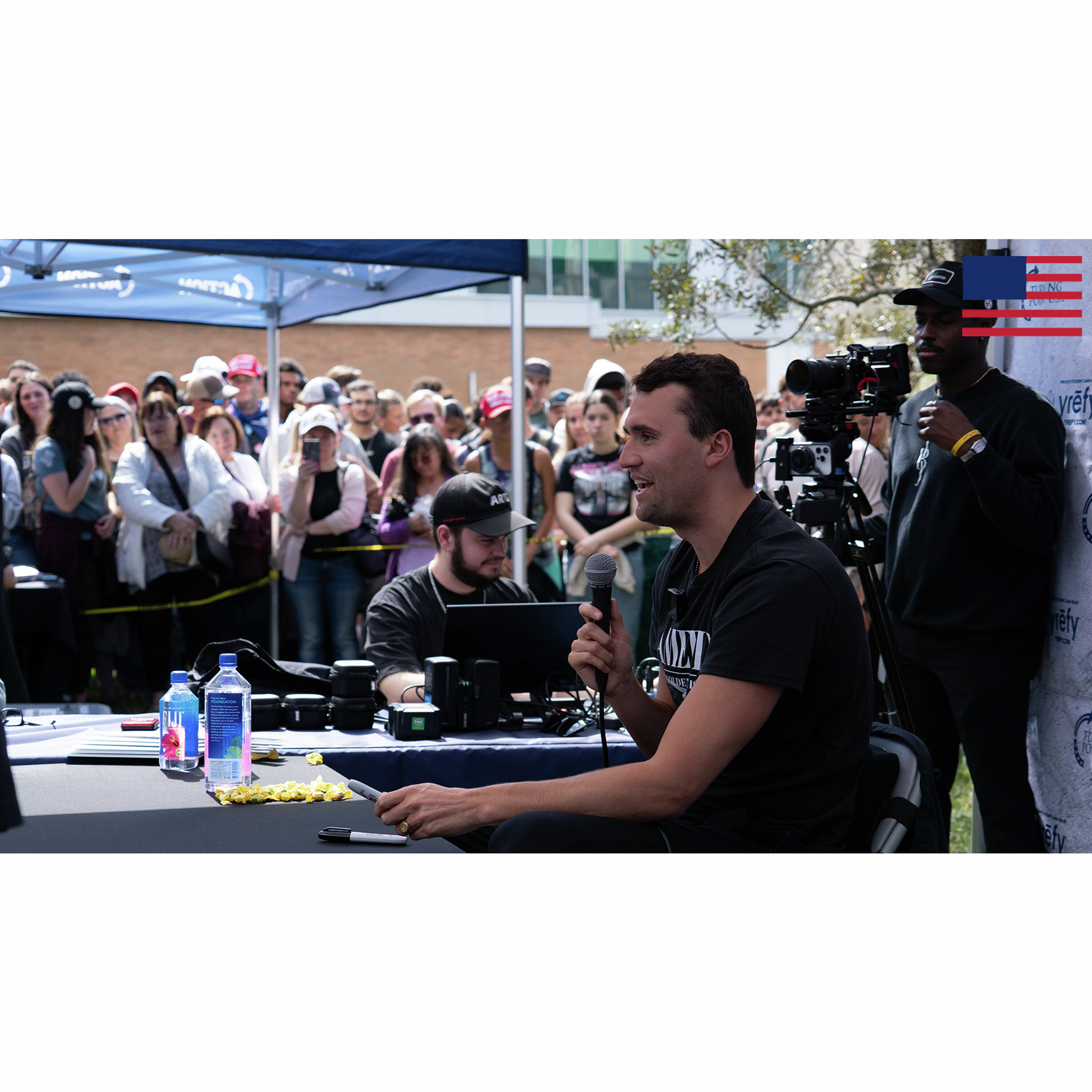

Charlie Kirk Staff

12/30/2024

Credit card defaults in the United States have reached their highest levels since 2010, according to a report released Sunday, another black eye for outgoing President Joe Biden and his administration.

The rising default rates indicate that many Americans’ incomes are failing to keep up with their spending and bill payments amid high interest rates and persistent inflation that remains above the Federal Reserve’s 2% target.

This, after nearly four years of inflationary ‘Bidenomics’ policies bolstered by massive spending bills passed by a Democratic-controlled Congress during Biden’s first two years in office.

Card lenders wrote off $46 billion in seriously delinquent loans during the first nine months of this year, marking a 50% increase compared to 2023, according to an analysis published by The Financial Times and based on industry data compiled by BankRegData.

These figures represent the highest levels in 14 years, the report noted.

Lenders typically write off delinquent debt, often after 120 days of nonpayment, when they determine that the borrower is unable or unwilling to repay the balance, Just the News reported.

Mark Zandi, the head of Moody’s Analytics, says high-income households are OK, “but the bottom third of U.S. consumers are tapped out. Their savings rate right now is zero.”

Member

Member