On Friday August 13, Zero Hedge reported the peak in daily COVID-19 infections due to the Delta variant would soon be upon us. “The US inflection is days away” The article quoted JPMorgan’s Marko Kolanovic as noting in “making his case for the bottom in yields and cyclical stocks.”

Also quoted was Morgan Stanley’s resident in-house biotechnologist Matthew Harrision: “with new cases in the US reaching ~120k/day, investor questions are centered around the timing of the new peak in cases. Based on the reproduction rate trajectory, US/UK hospitalization relationship, ad previous peaks, we expect the next peak to occur in ~1-2 weeks.”

Here we are, ten days later, and Zero Hedge reports “Matthew Harrison who, with uncanny precision, was spot on and exactly at the midpoint of ‘1-2 weeks later’ the ascent of Delta variant new cases in the US has now peaked, and it’s all downhill from here.”

“As for what it means for US society” writes Zero Hedge, “that the media and politicians will no longer be able to scaremonger with the Delta variant, that’s beyond the scope of this post, suffice to say that we fully expect the ‘independent media’ to quickly shift their focus to the ‘unexpected’ emergence of the lambda or some other, even ‘deadlier’ variant, which politicians will immediately weaponize in their neverending quest to convert the US into one giant authoritarian nanny-state.”

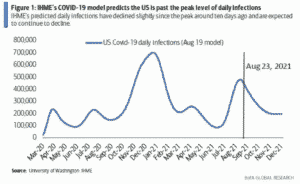

Additionally, Bank of America’s (BofA) Hans Mikkelson, used evidence such as the University of Washington’s IHME model to conclude “the US is not past the peak level of daily COVID-19 infections caused primarily by the Delta Variant.”

Zero Hedge reports:

But even the “much cleaner data” for number of people hospitalized with COVID-19 confirms that the peak is now in the rearview mirror: while the number rose “just” 7.8% the past week which, due to its lagged nature and very rapid pace of decline, Mikkelsen notes that this “is consistent with the US being past peak level infections.”

Moreover the recent one-percentage point decline in the COVID-19 test positive rate to 9.32% – another indicator that the US is now past peak level infections – highlights one driver of high daily case counts is merely more testing activity.

What does this mean for markets, if not the economy and political propaganda?

Well, if the US has not already seen peak COVID-19 case numbers, BofA is confident that reaching that milestone is “imminent.” More importantly, with the UK as guide, the decline in case numbers on the other side could be rapid.

The IHME model forecasts a 50% decline from peak level daily infections by October 11th, and by September 22 – the timing of the next FOMC meeting – the predicted decline is nearly 40%. This, according to BofA, bodes well for reopening trades that underperformed so far in 2H21 as the US COVID-19 situation deteriorated; it does not bode well for those who are praying that the delta variant will force the Fed to delay tapering.